Omni Account: A new paradigm for cross-chain interop

The first intent-powered Smart Account. Built on Across, in partnership with Magic Labs, a leading wallet provider

The first intent-powered Smart Account. Built on Across, in partnership with Magic Labs, a leading wallet provider

Rhinestone Protocol 1.0 is the first interoperability protocol for Modular Smart Accounts. It enables any developer to build self-contained components called Modules that securely extend the feature set of any Smart Account, making Modules the Smart Account equivalent of smartphone apps. The next frontier for the Rhinestone Protocol is to make Smart Accounts truly chain abstracted, from balance and address unification to module state synchronization.

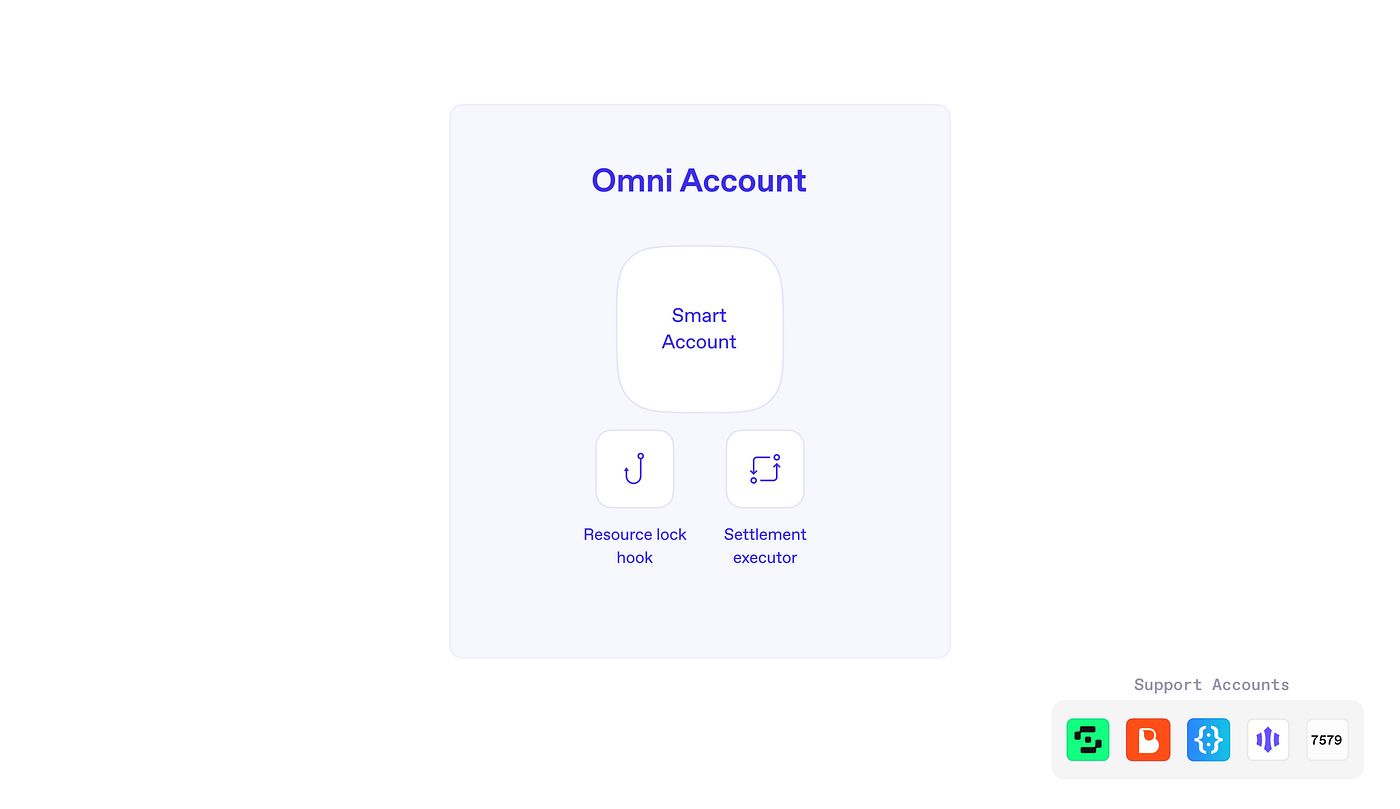

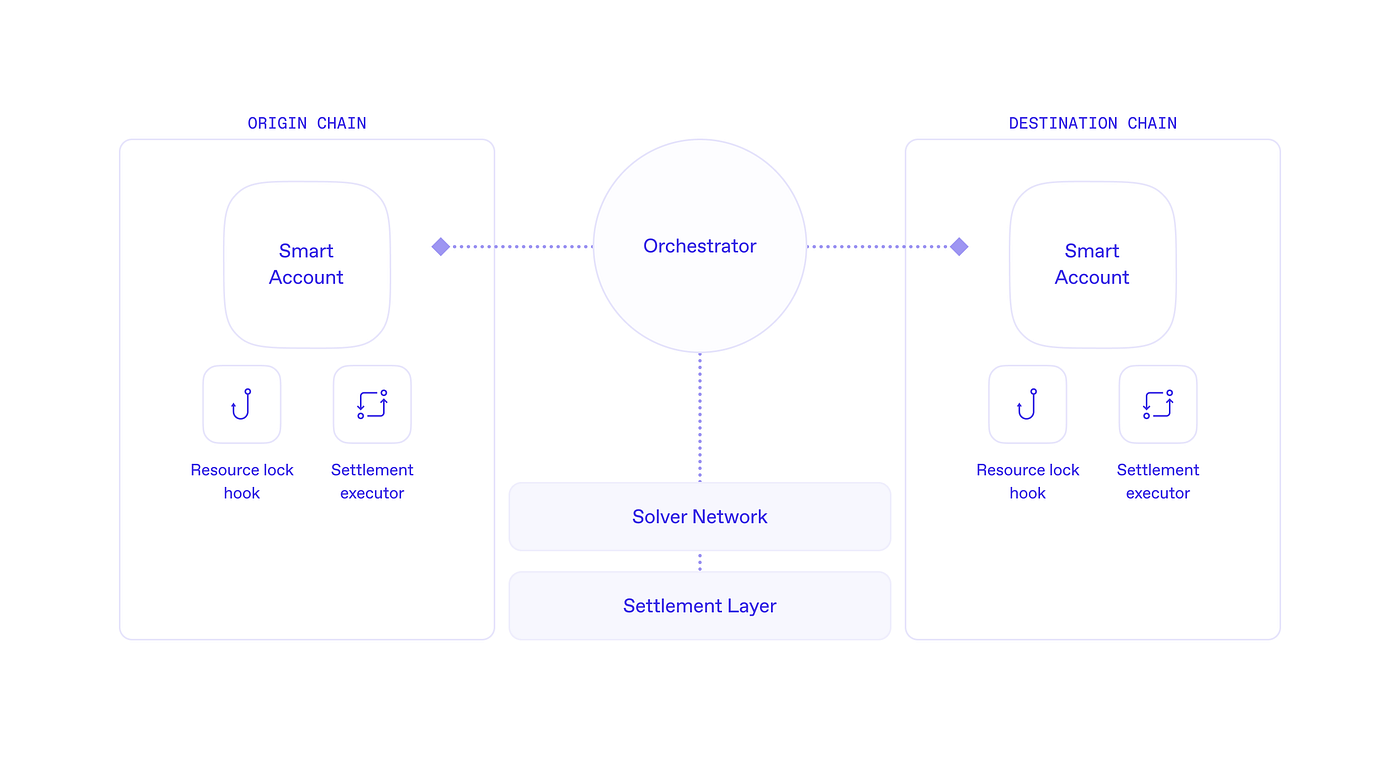

Today, we announce Omni Account, an intent-powered system that employs ERC-7579 Modules to transform ERC-7579 accounts and Smart EOAs (EIP-7702) into chain abstracted accounts. Omni Account has two core components: 1) the Resource Lock Hook to enable irrevocable onchain guarantees to offchain entities through a single signature, and 2) the Orchestrator, an offchain entity that sequences transactions and ensures users cannot break their onchain guarantees.

The Orchestrator is currently a single server-side system, but importantly, it is trustless for the user. The initial use case of instant and atomic cross-chain intents is built on Across, allowing the Orchestrator to inherit a robust optimistic proof system. Due to the onchain design of Omni Account, a malicious act from the Orchestrator can only lead to a deposit to the Across Spokepool which will simply return the funds to the user.

The vision for Omni Account goes far beyond solving Ethereum’s fragmented liquidity. Omni Account allows users to express any intent to a specialized execution layer without the strict requirement of atomized settlement. From debit card integrations to offchain order books, Omni Account’s architecture is designed to make resource locks fully open and composable to any developer. One single balance with infinite possibilities — everything everywhere all at once.

To unlock the limitless use cases of resource locks, Omni Account will utilize the full potential of modular Smart Accounts and extend the philosophy behind ERC-7579 (permissionless and open innovation) to the Orchestration layer — more on this below.

Omni Account is already in production, and partner integrations have begun. Check out our demo to see what this new system can do today!

Disclaimer: The demo wallet runs on unaudited contracts. These contracts are for testing and demonstration only.

We’re excited to work with Magic, a leading player in the wallet space, to bring Omni Account to market. Omni Account is built to be consumed by any application looking to instantly access cross-chain liquidity. However, when directly integrated into the wallet, the system reaches its maximum potential. Magic has been a key design partner for the Omni Account SDK, informing core features and infrastructure decisions.

Magic services some of the most significant crypto projects, including Polymarket, Immutable, WalletConnect, and Helium. They are fully integrated into Ethereum’s horizontal scaling strategy, with the Newton chain providing a core piece of the puzzle for the ecosystem’s fragmented UX. Rhinestone is excited to partner with Magic as a key distribution and GTM partner.

Omni Account consists of the following components:

Omni Account employs the Resource Lock Hook, an ERC-7579 module that hooks into every execution and checks a simple invariant: will the execution and any approvals made during execution reduce the account balance below the resource-locked amount? If false, the Resource Lock Hook allows the transaction to pass. If true, the transaction will only pass with a signature from the Orchestrator to ensure that those funds aren’t already being spent elsewhere.

This novel approach has many favorable traits when compared to the existing escrow and co-signer models by combining the best from both approaches:

The Resource Lock Hook employs an ERC-712 signature envelope to encode complex cross-chain intents into a single signature. This signature contains the cross-chain routes and arbitrary call data to be executed on the destination chain, allowing any intent to atomically execute with the cross-chain transfers once funds hit the destination chain Omni Account. From the user’s perspective, this is one signature for any instant intent.

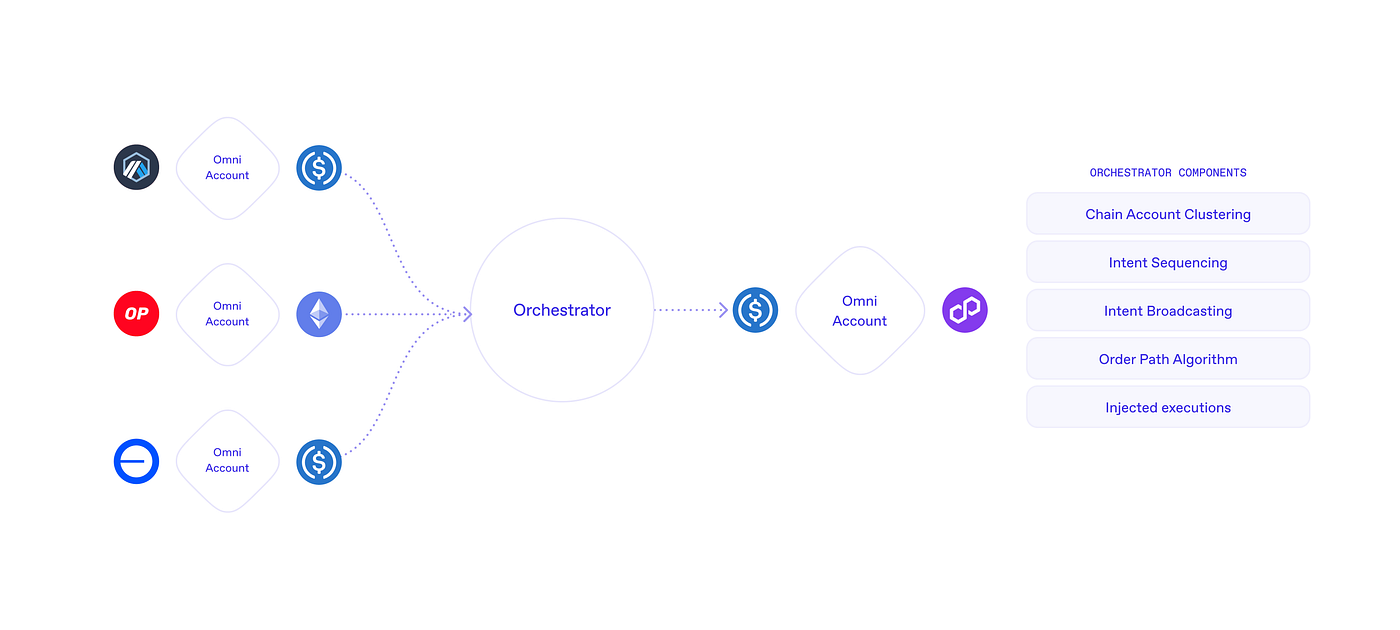

Omni Account provides M-to-1 origin chains to a destination chain and M-toN input tokens to output tokens. Solver-based swapping allows users to combine any supported token from any supported chain to execute any intent with one signature.

If Ethereum’s horizontal scaling strategy plays out as expected, the first time a user interacts with an onchain app will likely be their first interaction with a new chain. Therefore, a scalable Chain Abstraction system must enable instant cross-chain intents even if the user does not have an account on the destination chain. Omni Account provides this functionality with a just-in-time deployment flow. With one simple action, the user authorizes the intent and the deployment of the Omni Account.

Finally, the Omni Account system guarantees a deterministic output token (i.e., no slippage) and destination chain atomicity. Solver routing issues caused no partial fills or failed executions. This is all guaranteed without requiring a single solver to fill the entire intent.

The obvious counterpoint to the Resource Lock Hook is that it is incompatible with EIP-7702. The private key of an EOA delegated to an Omni Account can always subvert the lock. For this reason, the Resource Lock Hook module has been built to support the Compact, an open-source escrow specifically designed for cross-chain intents.

The Resource Lock Hook signature payload is structured to match the Compact. Therefore, to support EOAs, the developer activates an EIP-7702 flow that points the Resource Lock Hook to the Compact for balance unlocks. All other components and integration points are unchanged!

We’ve collaborated with Circle to make USDC the underlying token for any cross-chain intent. Hold USDC and instantly perform any cross-chain action: swap, LP, lend, borrow, or buy an NFT. Whatever the intent, the Omni Account system can transform the initial USDC position into a series of destination chain executions and cross-chain routes that lead to one atomic experience for the end user. A key ingredient to enabling this without wrapping USDC is the Resource Lock Hook. The hook has a pre-validation function that prevents the permit function on the USDC contract from bypassing the lock.

The Orchestrator acts as a trusted entity to enforce resource locks. It listens to user intents, propagates them to a solver network, creates resource lock allocations for counterparties (e.g., the Across Relayers), and facilitates the claim process via the chosen settlement layer (e.g., Across).

The Orchestrator is trustless from the end user’s perspective. This is achieved through Omni Account’s onchain architecture. The Orchestrator can only interact with the Smart Account via the Resource Lock Hook and the Settlement Executors, providing onchain verifiable transaction rails. The current Settlement Executors utilize the Across Protocol as the sole settlement layer. Even if the Orchestrator managed to transact without the user’s approval, the transaction could only be sent to the Across Spokepool, leading to a refund via Across’ optimistic proof system.

The Orchestrator also does not present any liveness and censorship risk to users. This is achieved via an onchain escape hatch that can be activated through an onchain call without dependency on Rhinestone or the Orchestrator.

At launch, sophisticated solvers are the only party that needs to trust the Orchestrator. They must trust that the accounting and security checks are performed correctly, preventing users from doublespending the system. However, solvers do not depend on the Orchestrator for claim requests. This process is permissionless and trustless.

The Orchestrator only co-signs transactions involving locked funds (unlike a co-signer approach that requires signing every Smart Account interaction), making the system significantly more straightforward to operate and maintain. This reduced complexity creates a more efficient path toward solving the second challenge of verifiably correct sequencing and security checks. The Orchestrator has been built in Rust, and zkVM is being explored to provide a verifiable and trusted computing environment. Our mission is to make the Orchestration layer open and permissionless, and we’ll be publishing research and diving into this with early partners building on resource locks.

Our vision is for the Orchestration layer to exhibit properties similar to those of ERC-7579, allowing developers to spin up an application-specific Orchestrator node that can provision allocations and claims on a single locked balance per user. The core component is a shared and verifiable intent queue. We’re in the early ideation phase of architecting this multi-modal orchestration layer and are open to collaboration. If you’re developing a product that can benefit from account-native resource locks, please reach out!

Omni Account significantly levels Ethereum’s UX and interop, unifying account implementations and chains. Starting with Safe, Nexus, and Magic’s Newton, Omni Account unifies balances across all EVM-compatible chains and enables users to express any intent to a specialized execution layer without the strict requirement of atomized settlement. For the user, these actions are instant and atomic, completely removing the concept of a “network” from the web3 application UX.

Omni Account is in production under a private beta. Please reach out for an API key to get started!